franklin county ohio sales tax rate 2020

The state sales tax rate in Ohio is 5750. If you need access to a database of all Ohio local sales tax.

Ohio Taxes Apps On Google Play

2022 4 th Quarter Rate Changes.

. DEPARTMENT OF TAXATION. COLUMBUS OH 43216-0530. What is Ohio sales tax rate 2020.

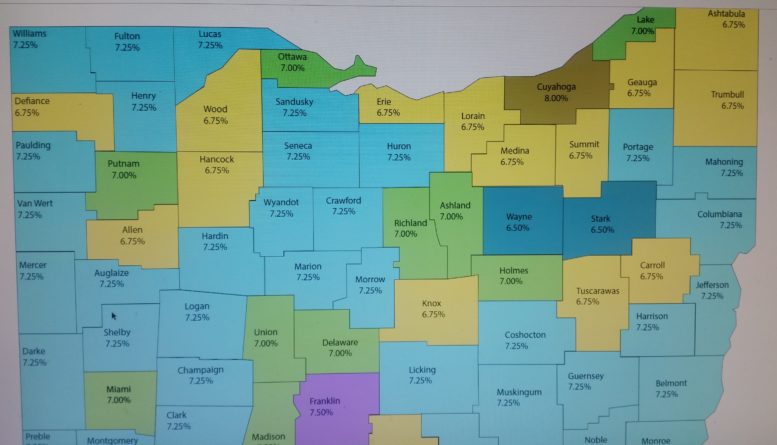

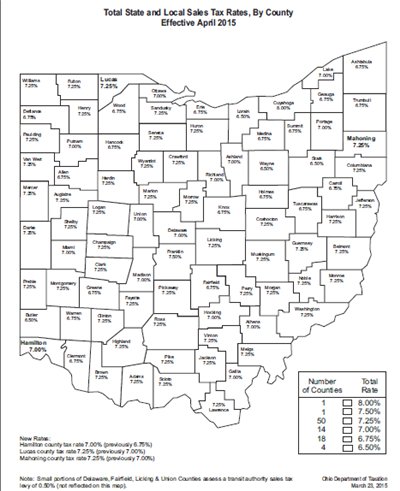

- The Finder This online tool can help determine the sales tax rate in effect for any address in. 2020 tax rate information Tax Year. State and Permissive Sales Tax Rates by County April 2022.

The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. PAGE 1 REVISED October 1 2020.

Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. What is the sales tax rate in Franklin County. Current Sales Use Tax Rate Changes.

The December 2020 total local sales tax rate was also 7000. 2020 rates included for use while preparing your income tax deduction. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax.

2022 3 rd Quarter. FISCAL FRAN Tax Rate Information Tax-Rate-2020. To automatically receive bulletins on sales tax rate changes as they become.

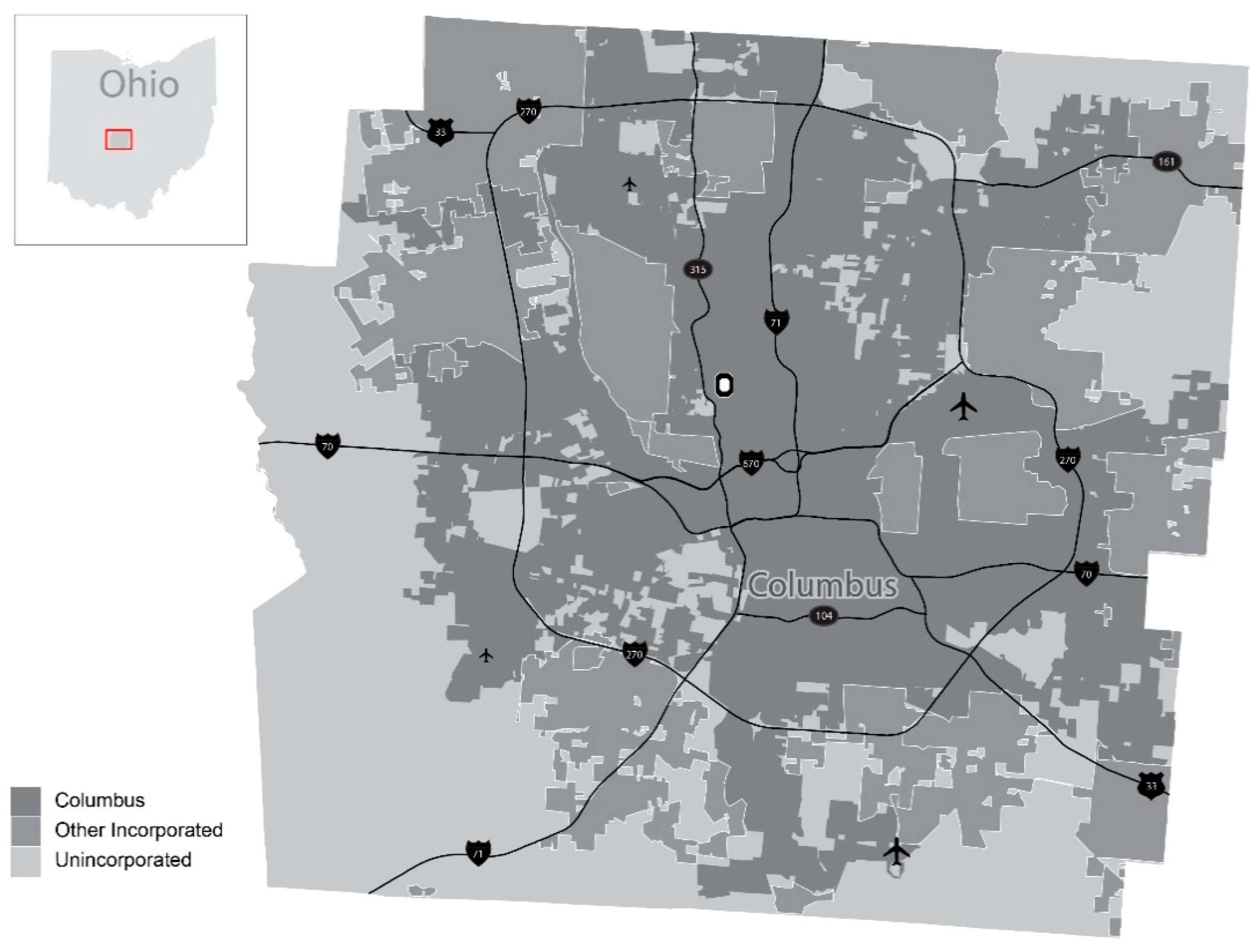

This rate includes any state county city and local sales taxes. Office of Diversity Equity Inclusion ODEI Franklin County Data Center Disclaimer. Unclaimed Funds FAQ.

This is the total of state and county sales tax rates. How much is sales tax on a. 1 lower than the maximum sales tax in OH.

The latest sales tax rate for Franklin Furnace OH. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. Unclaimed Funds Search.

The latest sales tax rate for Franklin County OH. The sales tax jurisdiction. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled.

STATE OF OHIO. With local taxes the total sales tax rate is between 6500 and 8000. 2020 rates included for use while preparing your income tax deduction.

The following list of Ohio post offices shows the total county. There is no applicable city tax or. The current total local sales tax rate in Franklin OH is 7000.

This rate includes any state county city and local sales taxes. There were no sales and use tax county rate changes effective October 1 2022. There is no applicable city tax.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the.

News From Geauga Portage Lake Counties And Townships

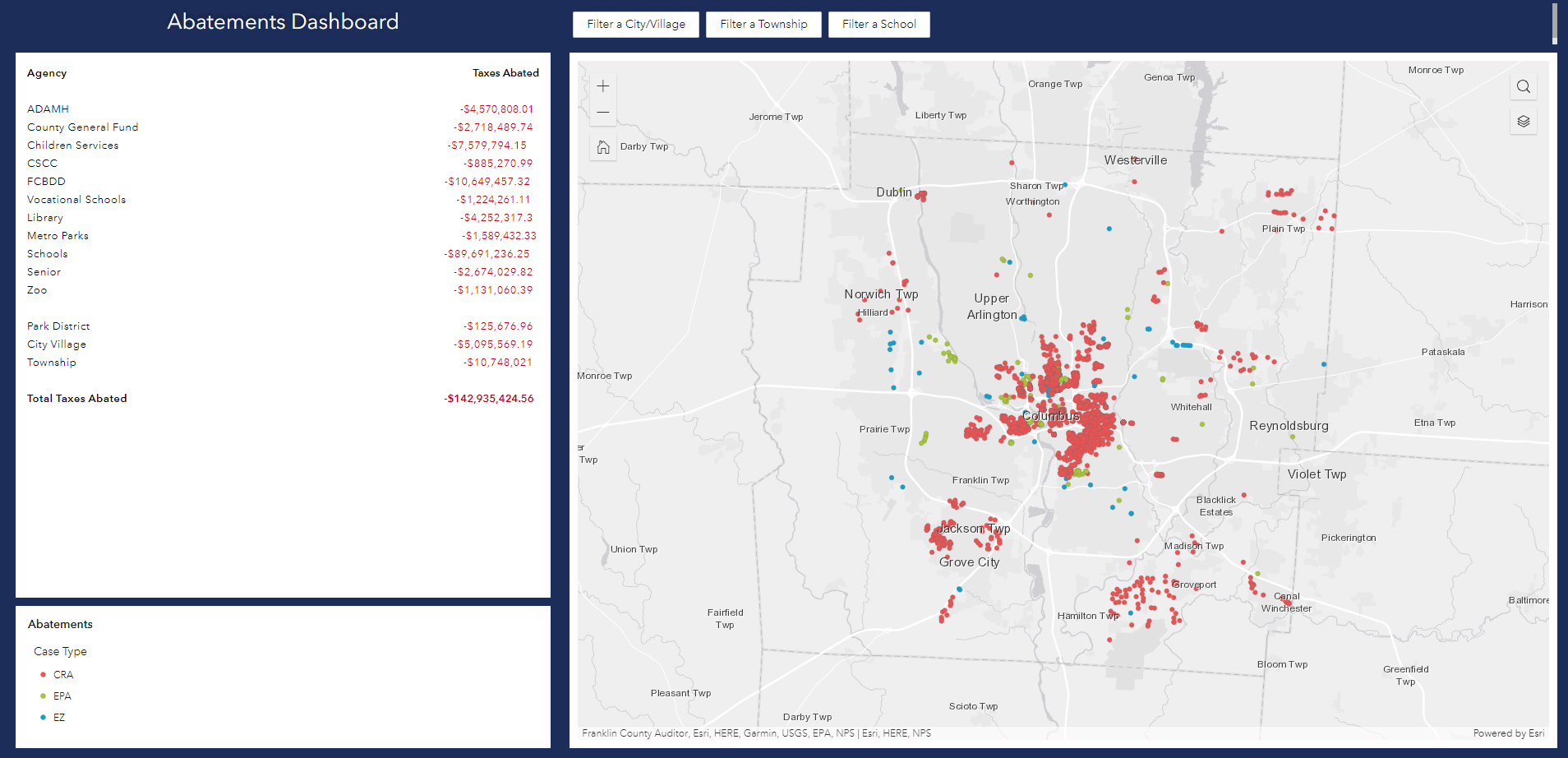

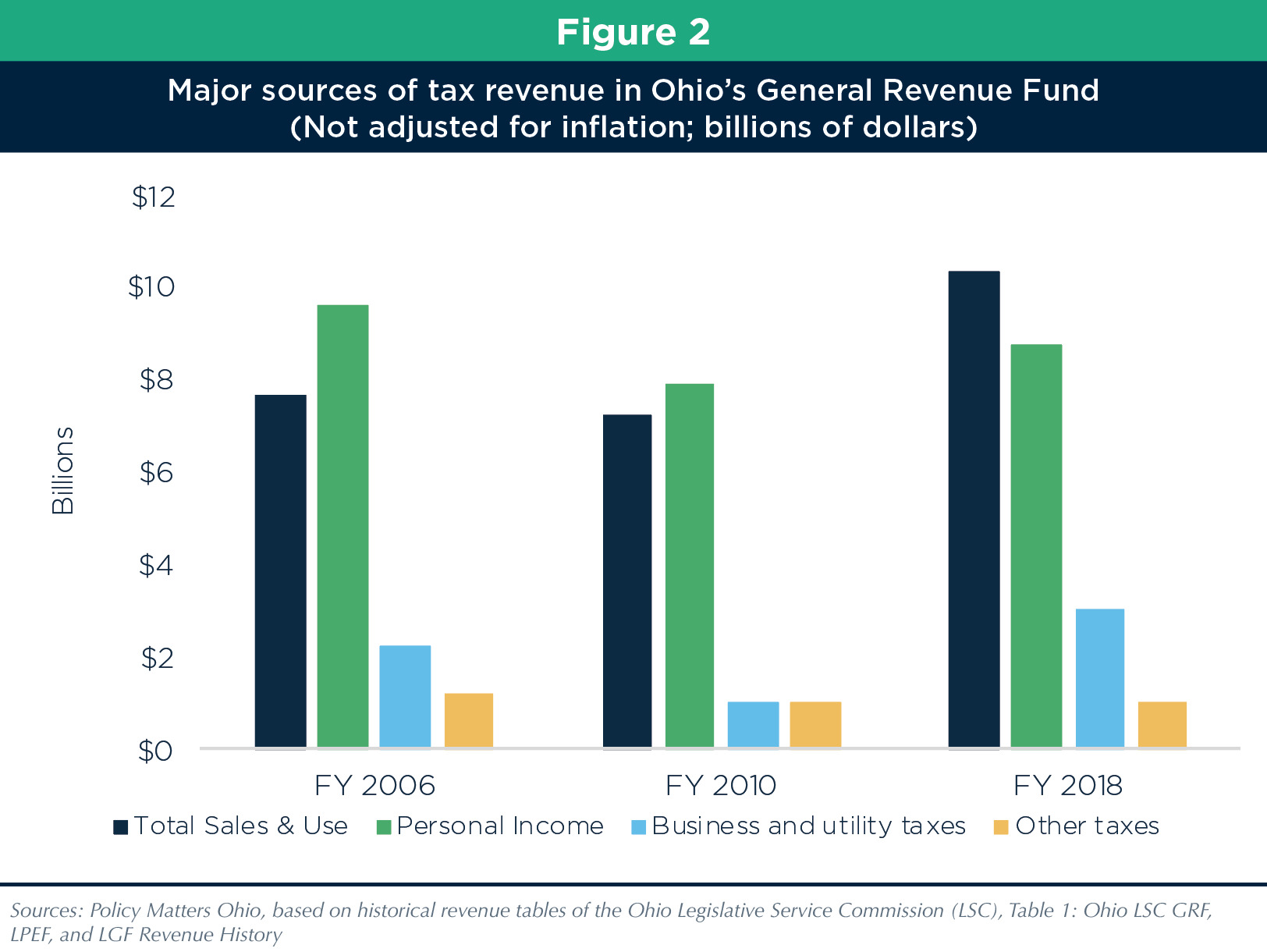

Property Tax Abatements How Do They Work

Abatements Franklin County Tax Incentives

4th Lawsuit Challenges Ohio Law Taxing Remote Workers Based On Their Former Work Address Ahead Of Coronavirus Cleveland Com

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ohio Commercial Property Reassessment Cheat Sheet

Ohio Sales Tax Guide For Businesses

Virginia Sales Tax Rates By City County 2022

Ohio Cities Try To Calculate Income Tax Hit From Those Working At Home

Cracking And Packing How Ohio S Redistricting Proposal Solves Some Problems Creates Others Nbc4 Wcmh Tv

Ijerph Free Full Text Neighborhood Level Lead Paint Hazard For Children Under 6 A Tool For Proactive And Equitable Intervention Html

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

Georgia Sales Tax Rates By City County 2022

Sales Tax Tuesday Ohio Insightfulaccountant Com

Income Tax City Of Gahanna Ohio